Yes, you can get a mortgage with a 600 credit score, but options may be limited. Lenders typically prefer higher credit scores but offer specific loan products for lower scores.

Securing a mortgage with a 600 credit score is a plausible endeavor, but it usually comes with certain caveats. A score in this range signals to lenders that you’re a higher-risk borrower, which might lead to higher interest rates and stricter lending terms.

Nevertheless, the possibility remains for hopeful homebuyers. Certain government-backed loans, such as FHA loans, are designed to help those with lower credit scores. These loans can offer a lifeline to individuals with a 600 credit score, enabling them to achieve homeownership. It’s essential to position yourself as a trustworthy borrower by demonstrating a stable income, a low debt-to-income ratio, and a willingness to consider a reasonable loan amount that aligns with your financial capabilities. Engaging with a financial advisor or a mortgage broker can provide personalized advice and expand your options for a suitable mortgage product.

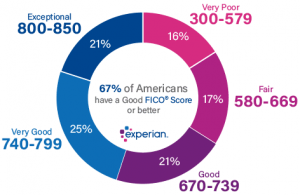

Credit: www.experian.com

Credit Score 101: The Basics And Impact

Credit scores influence many financial moves, especially mortgages. A score of 600 sits on the edge, impacting options and offers. Understanding how credit scores work is crucial.

What Is A Credit Score?

A credit score is a number between 300 and 850. It shows creditworthiness. Lenders use it to decide lending money risks. High scores mean better loan terms. Here’s what scores mean:

- Excellent: 800 and above

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: Below 580

Several factors determine a credit score:

- Payment History: On-time payments boost scores.

- Credit Utilization: Using less credit than available helps.

- Length of Credit History: Longer histories are better.

- New Credit: Opening many accounts quickly can lower scores.

- Types of Credit: A mix of account types may improve scores.

How Does A 600 Score Affect Mortgage Eligibility?

With a 600 credit score, mortgage options exist but are limited. Traditional lenders might hesitate, leading to higher interest rates. Government-backed loans may be more accessible. Look at these potential impacts:

| Type of Loan | Typical Minimum Credit Score | Impact of 600 Score |

|---|---|---|

| Conventional | 620+ | Higher rates or denial |

| FHA | 580+ | Possible approval with higher down payment |

| VA | Varies by lender | More forgiving but still challenging |

Options like FHA loans are designed for lower credit scores. A 10% down payment can lead to approval. Improving credit scores opens more doors and better rates.

600 Credit Score Mortgages: What Are Your Options?

Getting a mortgage with a 600 credit score is possible. Your options vary. Some loans are more flexible. Below, explore what’s available for a credit score like yours.

Conventional Loans Possibilities

Conventional loans often require higher credit scores. But, with a 600 score, you might still qualify. You will likely need a larger down payment or a lower debt-to-income ratio to compensate. Here are key points to consider:

- Private lenders offer these loans.

- Credit score requirements vary by lender.

- A score of 600 might mean higher interest rates.

- A 20% down payment could waive private mortgage insurance (PMI).

Government-backed Loans: A More Lenient Approach

Government-backed loans tend to be more forgiving. They’re ideal for buyers with lower credit scores. Check these options:

| Loan Type | Features | Credit Score |

|---|---|---|

| FHA Loan | Lower down payments, flexible guidelines | Minimum 580 for 3.5% down, 500-579 for 10% |

| VA Loan | No down payment for qualified veterans | Varies by lender, some accept 600 |

| USDA Loan | No down payment for rural and suburban buyers | Typically 640, but exceptions exist |

Even with a 600 credit score, owning a home is not out of reach. Consider both conventional and government-backed loan options. Each has benefits. Choose the best fit for your financial situation.

Improving Your Chances: Strategies To Enhance Your Credit

Securing a mortgage with a 600 credit score may seem tough. You can improve your odds, though. With the right strategies, you boost your credit score. Here’s how to make lenders smile.

Credit Improvement Techniques

Fix errors on your credit report. Start by checking your credit report for mistakes. Dispute any errors you find; this can help improve your score swiftly.

Pay bills on time. Always pay bills before they’re due. This shows lenders you’re trustworthy.

Reduce debt where possible. Lower your credit card balances. A lower debt-to-income ratio looks good on your credit report.

Keep old credit accounts open. Don’t close unused credit cards. A long credit history can help your score.

Avoid new credit inquiries. Don’t apply for new credit. Each application can lower your score a little bit.

Building A Stronger Credit Report

Making your credit report shine is key. Here are steps to build a stronger credit profile.

- Pay down existing debt. Keep your credit usage low. Lenders like this.

- Stay consistent with credit payments. Late payments hurt your score. Pay on time, every time.

- Mix it up. Having different credit types can benefit your score. This includes loans and credit cards.

- Limit credit applications. Only apply for credit if it’s absolutely necessary. Each hard inquiry can chip away at your score.

By implementing these techniques, expect a better credit score. This makes getting a mortgage easier. Stay patient, as credit improvement doesn’t happen overnight. But with dedication, you’ll get there.

Understanding Mortgage Qualification Criteria

For many, a dream of homeownership begins with getting a mortgage. With a credit score of 600, you may wonder about your mortgage options. Qualifying for a mortgage requires looking beyond just your credit score. Lenders also weigh in your income, job history, as well as your current debts. Let’s dive deeper into the criteria that decides if you can call a new place home.

Income And Employment Verification

Your job and income stability are key factors in the mortgage process. Lenders want to make sure you earn enough to handle monthly payments. They’ll need documents like pay stubs, tax returns, and W-2 forms. A consistent work history also assures lenders of your job security. Varied employment or recent job changes could raise red flags.

Debt-to-income (dti) Ratios And Their Importance

The Debt-to-Income (DTI) ratio is critical. It’s the percentage of your monthly income that goes toward paying debts. A lower DTI suggests you manage debts well and can afford a mortgage. Lenders prefer a DTI below 43% for most loan types, though some may be more lenient. Calculating your DTI before applying helps set expectations.

Here’s what lenders consider in the DTI ratio:

- Monthly debt payments: These include credit cards, loans, and other debts.

- Gross monthly income: Your income before taxes.

Keep these criteria in mind, and you’ll be better prepared to tackle your mortgage application.

Down Payment’s Role With A 600 Credit Score

Planning to buy a home can be thrilling. Your credit score plays a big part. A 600 credit score might feel like a barrier. Yet, it’s still possible to get a mortgage. The down payment becomes a key player here. Let’s dive into how a down payment affects getting a mortgage with a 600 credit score.

Minimum Down Payment Requirements

Different loans have different rules. For a 600 credit score, there are options. FHA loans could be your friend. They usually ask for 3.5% down. But with a 600 score, you might need 10%. Conventional loans might need more. They often want at least 5% down. Other loan types have their own rules.

| Loan Type | Minimum Down Payment |

|---|---|

| FHA Loan | 10% with 600 Credit Score |

| Conventional Loan | 5% |

| Other Loans | Varies |

The Benefits Of A Larger Down Payment

A larger down payment helps. Think of it as a helpful tool. It means lower monthly payments. You save on interest. You could get better mortgage rates. And you might avoid mortgage insurance. Less risk for lenders equals more benefits for you.

- Lower Monthly Payments

- Less Interest Over Loan Life

- Potentially Better Mortgage Rates

- Avoidance of Mortgage Insurance

More down payment equals more house options. With a 600 score, it’s tough. But a bigger down payment shows lenders you’re serious. It could boost your chances.

Interest Rates And Fees: A 600 Score’s Impact

Diving into the world of mortgages with a 600 credit score, one must understand the tandem play of interest rates and fees. Lenders often view a 600 score as a bridge between risk and potential. This directly influences borrowing costs.

Interest Rate Expectations

Credit scores play a crucial role in determining interest rates. A 600 score can lead to higher-than-average rates. Lenders attempt to offset the risk associated with lower credit scores. It’s essential for buyers to shop around for the most competitive rates.

- FHA loans might offer more lenient rates despite a 600 score.

- Conventional lenders generally require higher interest payments.

Additional Costs To Anticipate

Aside from interest rates, a 600 score can result in various additional fees. Understanding these expenses is key to planning your mortgage.

| Fee Type | Description | Impact |

|---|---|---|

| Origination Fee | Charged by lender to process loan | Can be higher for low scores |

| Mortgage Insurance | Protection for lender if you default | Often mandatory for scores < 600 |

| Closing Costs | Final fees in the home buying process | May include additional risk surcharges |

In some cases, lenders might offer adjustments or credits to mitigate these costs. Prospective borrowers should negotiate and compare lender’s fees to ensure a fair deal.

The Loan Application Process With A 600 Credit Score

Securing a mortgage with a credit score of 600 may seem daunting. But it is possible. Lenders have varying criteria for loan approval. A score of 600 falls in the fair range. This means options are available, but they come with higher interest rates. Understanding the pathway to apply for a mortgage opens up avenues for homeownership. Prepare for a more rigorous process, and showcase your financial stability through other means.

Steps To Apply For A Mortgage

Applying for a mortgage requires a clear action plan. Here are the crucial steps to follow:

- Check your credit report for any errors that could be impacting your score.

- Gather all financial documents you’ll need for the loan application.

- Research lenders that offer loans to buyers with lower credit scores.

- Consider applying for a mortgage backed by the Federal Housing Administration (FHA).

- Get pre-qualified to understand how much you might borrow.

- Compare interest rates and terms from different lenders.

- Submit your mortgage application and await the lender’s decision.

Gathering Necessary Documentation

Lenders will review your financial health. Documentation is crucial. Here’s what you will need to provide:

| Document Type | Description | Why It’s Important |

|---|---|---|

| Proof of Income | Recent pay stubs, tax returns, W-2 forms, or 1099 forms | Confirms your ability to repay the loan |

| Proof of Assets | Bank statements, retirement accounts, or other investment records | Shows financial stability beyond income |

| Credit Report | Lender obtained report, but personal copies help you address any discrepancies | Highlights creditworthiness |

| Identification | Driver’s license, passport, or other government-issued ID | Confirms your identity |

Gather these documents early to expedite the process. Approach lenders with confidence and preparedness. Be willing to explain the reasons behind a 600 score. Demonstrate how you’ve managed your finances responsibly despite past challenges.

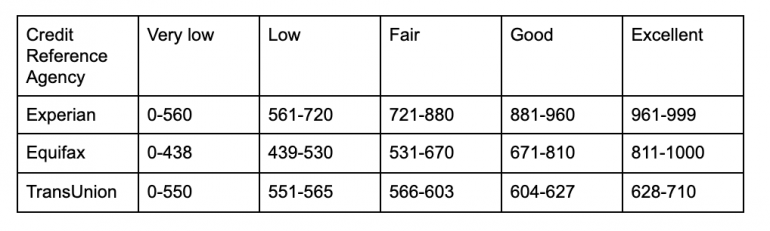

Credit: www.themortgagehut.co.uk

Success Stories: Obtaining Mortgages With Similar Credit Scores

A credit score of 600 often appears as a stumbling block on the path to homeownership. Yet, numerous individuals have defied the odds.

Real-life Borrower Experiences

Real-life stories flood the mortgage landscape, offering a glimmer of hope to those dreaming of their own home.

- Jane Doe clinched a mortgage deal despite her 605 score. She presented a stable job history and a substantial down payment.

- John Smith overcame his 600 score by finding a lender focused on manual underwriting, which considered more than his credit score.

- Another couple combined their efforts. Saving meticulously, they compensated for their 610 score with a larger down payment, thus securing a loan.

Learning From Others’ Mortgage Journeys

Understanding how others have successfully navigated the mortgage process can be invaluable. Let’s break down the essentials:

- Improve credit factors: focus on reducing debts and never missing payments.

- Seek alternative lenders: some institutions specialize in loans for lower credit scores.

- Opt for pre-approval: this can reveal potential issues to address early in the process.

- Explore government-backed loans: options like FHA loans could be more attainable.

Each journey teaches that determination, strategy, and informed choices pave the way to securing a mortgage, even with a credit score at or around 600.

Credit: www.homelendingpal.com

Frequently Asked Questions On Can I Get A Mortgage If My Credit Score Is 600

What Kind Of Home Loan Can I Get With A 600 Credit Score?

With a 600 credit score, you may qualify for an FHA loan, which requires a score of at least 580 for a low down payment. Some lenders may also offer subprime loans, but these often come with higher interest rates and fees.

How Much Can You Get Approved For With 600 Credit Score?

With a 600 credit score, loan approval amounts vary widely based on the lender and individual circumstances. Generally, you may face lower limits and higher interest rates. It’s essential to shop around for the best terms.

What Is The Lowest Credit Score For A Mortgage?

The lowest credit score typically required for a conventional mortgage is 620. Government-backed loans like FHA may allow for scores as low as 500 with a 10% down payment.

Is 660 A Good Credit Score To Buy A House?

A 660 credit score is considered fair and may suffice for a house purchase, but better terms are available with higher scores. Eligibility depends on lenders’ requirements and the loan program.

Is 600 Credit Score Mortgage Possible?

Yes, obtaining a mortgage with a 600 credit score is possible, but options may be limited and interest rates could be higher.

Conclusion

Securing a mortgage with a 600 credit score is challenging, but not impossible. Creative solutions and financial strategies can unlock home ownership paths. Prioritize credit improvement for more options and potentially lower interest rates. Key takeaway: perseverance and informed decisions turn your homeownership dream into reality, even with a 600 credit score.