Use a line of credit to pay off a mortgage faster by making larger principal payments. This strategy reduces the interest paid over the loan’s life and shortens the payoff period.

Understanding how to leverage a line of credit for mortgage repayment can lead to significant financial gains. By drawing from a line of credit, homeowners can make lump sum payments directly toward their mortgage principal, thus diminishing the interest accumulated over time.

Opting for this method requires financial discipline, as it involves managing the repayment of both the line of credit and the mortgage. Knowing the ins and outs of interest rates and payment schedules is key to ensuring this approach saves money in the long run. This guide offers a streamlined way for homeowners to navigate this strategy effectively, allowing for a faster journey to becoming mortgage-free.

:max_bytes(150000):strip_icc()/Basics-lines-credit_final-0c20f42ed1624c349604fdcde81da91c.png)

Credit: www.investopedia.com

Introduction To Lines Of Credit

Clever homeowners are turning to lines of credit to pay off mortgages faster. A line of credit is a flexible loan. It lets you borrow, repay, and borrow again up to a certain limit. This approach can lead to significant interest savings.

A line of credit (LOC) is a preset borrowing limit that you can use at any time. The bank or lender approves the LOC. You can draw money as needed, up to the credit limit. The interest only applies to the amount you use, not the entire line.

- Flexibility: Use funds for various expenses.

- Reusable: Borrow, repay, and borrow again.

- Interest rates: Usually lower than credit cards.

| Feature | Line of Credit | Traditional Loan |

|---|---|---|

| Flexibility | High | Low |

| Funds Accessibility | As needed | Lump sum |

| Interest Calculation | On amount used | On total loan |

In contrast to a LOC, a traditional loan gives you a lump sum. You start paying interest on the full amount right away. With a loan, your payments are fixed, covering both the principal and interest.

A LOC offers a revolving balance. This means you can tap into it as per your financial needs. A mortgage, for instance, is a type of traditional loan specifically for buying property.

Credit: m.youtube.com

Advantages Of Paying Mortgage With A Line Of Credit

Using a line of credit to pay your mortgage can be a smart financial strategy. Not only could it help you pay off your mortgage faster, but you might also save on interest and enjoy repayment flexibility. Let’s explore how this can benefit homeowners.

Interest Savings Potential

A line of credit often comes with a lower interest rate than a mortgage. This means each payment can have a bigger impact on reducing your principal balance.

- Interest accrues daily: Pay more often to save on total interest.

- Larger payments reduce principal: More of your payment goes towards the loan balance.

Flexibility In Repayment

With a line of credit, you can adjust your payments. Choose to pay more when you can and less when you need to.

| Feature | Benefit |

|---|---|

| No pre-payment penalties | Make extra payments without fees |

| Re-borrow funds | Access funds for emergencies or other needs |

Understanding Your Mortgage Structure

Before using a line of credit to pay off a mortgage, it’s key to grasp how the mortgage itself works. Understanding the structure lays the groundwork for savvy debt management. Let’s break down the components that make up a mortgage payment and the concept of mortgage amortization.

Components Of A Mortgage Payment

Every mortgage payment has several parts. Grasping these ensures you’re well-equipped to tackle the loan.

- Principal: The original loan amount.

- Interest: The cost of borrowing the principal.

- Escrow: Funds for taxes and insurance, if included.

Principal and interest are the core parts. Escrow is a monthly saving plan for your yearly bills.

Mortgage Amortization Explained

Mortgage amortization shows how payments are split over time.

| Year | Principal Paid | Interest Paid | Remaining Balance |

|---|---|---|---|

| 1-5 | Small amount | Large amount | Decreases slowly |

| 6-10 | Grows larger | Reduces slightly | Decreases faster |

In the early years, you pay more interest. As years pass, principal payment grows. Tracking your amortization schedule is important for an effective pay-off strategy.

The Heloc Strategy: Detailed Breakdown

Welcome to our detailed breakdown of the HELOC strategy. This innovative approach can help homeowners pay off their mortgage faster. Understanding how it works could save you money and years of debt. Let’s dive into the nuts and bolts of this strategy.

Setting Up A Home Equity Line Of Credit

A HELOC lets you access home equity without selling. To set one up, you need substantial equity in your home. You apply with a lender, just like you did for your mortgage. They assess your credit score and home value.

- Find multiple lenders for the best rates.

- Understand the terms, like draw periods and interest rates.

- Confirm no extra fees are hidden in the fine print.

Setting up a HELOC takes weeks. Start soon and plan ahead.

Using Heloc To Accelerate Mortgage Payments

The HELOC strategy hinges on using the credit line to pay down your mortgage faster. Draw funds from the HELOC and apply them to your mortgage principal.

- Calculate your monthly mortgage expenses, including interest.

- Borrow that amount from your HELOC.

- Immediately apply it to your mortgage principal.

This process reduces your mortgage balance. Lower balance means less interest over time.

Next, pay down the HELOC. Use your income and budget wisely. Aim to pay the HELOC off quickly. This resets your credit line. It allows you to repeat the cycle.

Remember, discipline is key. Avoid using the HELOC for other expenses.

Tracking progress is vital. Set milestones and celebrate each achievement.

Calculating The Financial Impact

Let’s tackle how to use a line of credit to melt down your mortgage quicker. Understanding the dollars and cents of this strategy is a game-changer. We’re diving into the math to unlock its potential. Keep your eyes peeled for key savings spots!

Interest Rate Comparisons

First, size up the interest rates. Your line of credit might have a lower rate than your mortgage. That’s good news for your pocket!

Here’s a clear-cut example:

| Mortgage Interest Rate | Line of Credit Interest Rate | Rate Difference |

|---|---|---|

| 4.5% | 3.5% | 1.0% |

Note the gap. Even a 1% difference saves bucks over time.

Long-term Savings Projection

Seeing the long-term savings picture helps. Shift cash from your line of credit to your mortgage. Track the savings grow.

Imagine you transfer $10,000. What’s the payoff? Let’s crunch those numbers.

| Years | Mortgage Interest Saved | Line of Credit Interest | Total Savings |

|---|---|---|---|

| 5 | $2,250 | $1,750 | $500 |

| 10 | $4,500 | $3,500 | $1,000 |

Witness how the interest from your mortgage morphs into a win with time.

- Shorter mortgage life means owning your home outright, faster.

- Less interest overall keeps more money in your world.

Put this plan in motion and watch your mortgage fade while your savings climb.

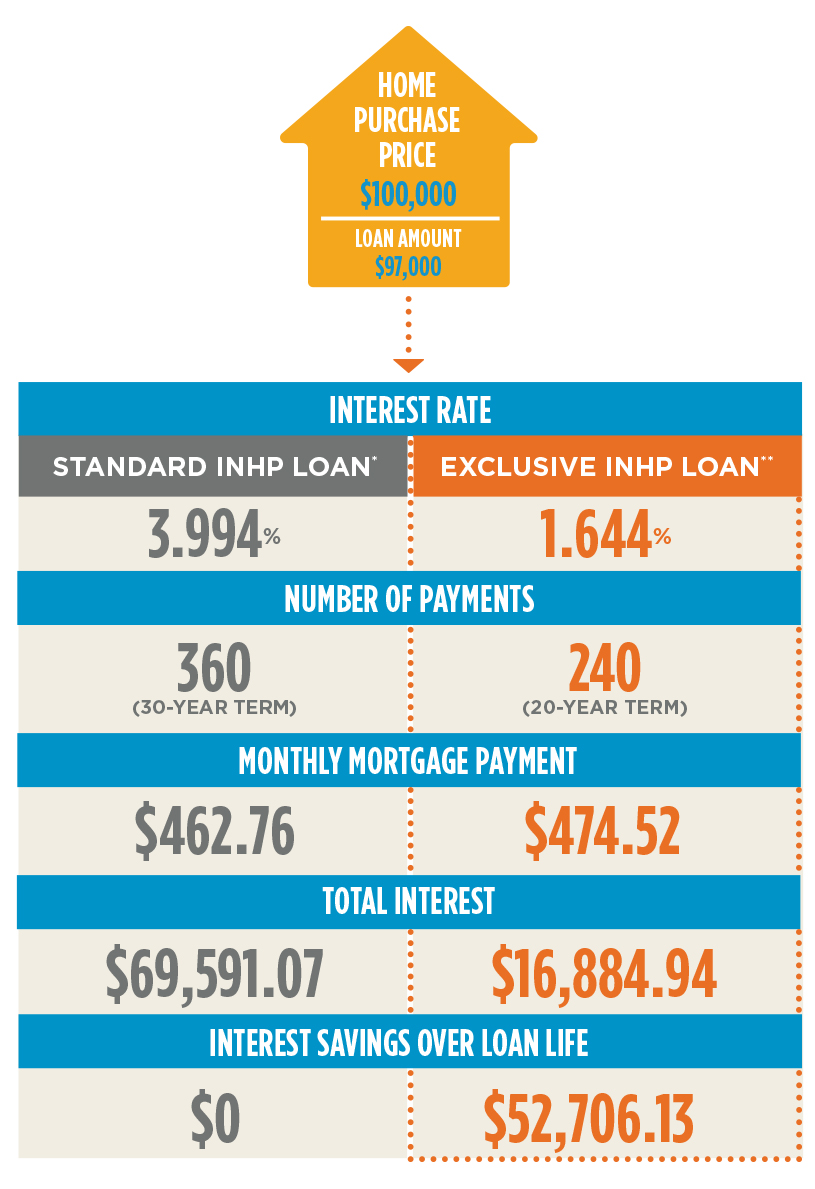

Credit: www.inhp.org

Step-by-step Guide To Using Credit Lines Effectively

Welcome to the ‘Step-by-Step Guide to Using Credit Lines Effectively’. This section will explore how a line of credit can accelerate mortgage repayment. Smart financial strategies and planning are keys to this process. Follow our easy guide to learn how to use credit lines to your advantage.

Assessing Your Financial Situation

Before using a line of credit to pay your mortgage faster, understand your current financial status. Evaluate your income, expenses, debts, and credit score. This understanding lets you make informed decisions.

- Check your budget to see how much you can allocate for mortgage repayment.

- Evaluate other debts to prioritize which loans to pay off first.

- Review your credit score, as it affects the interest rates you receive.

Creating A Repayment Plan

With a clear financial picture, you’re ready to create a plan. Aim for a repayment strategy that’s aggressive yet sustainable. Consider these steps:

- Determine extra payment amounts based on your budget assessment.

- Decide on the frequency of line of credit withdrawals.

- Automate the process if possible, so you remain consistent with payments.

Remember: The goal is to reduce interest costs and pay off the mortgage faster. Adjust your plan if your financial situation changes.

Risks And Considerations

Understanding the risks and considerations is crucial when using a line of credit to pay off a mortgage faster. While this strategy can save on interest and reduce the loan term, it’s not without potential pitfalls. It’s important to be aware of the risks before making a decision that could impact your financial stability.

Potential For Increased Debt

Using a line of credit to pay off a mortgage involves discipline. The open nature of this credit can tempt borrowers to use funds for other purposes, resulting in higher debt levels. Sticking to a repayment plan is essential to avoid spiraling into more debt.

- Monitor spending to prevent misuse of funds.

- Create a strict budget for line of credit use.

- Track your repayment progress regularly.

Market Risks And Interest Rate Fluctuations

A line of credit usually comes with a variable interest rate, making it sensitive to market changes. Fluctuations in interest rates can affect repayment amounts and the overall cost of borrowing. It is essential to understand these risks:

| Market Condition | Effect on Line of Credit |

|---|---|

| Interest Rate Increases | Higher monthly payments, more interest paid |

| Interest Rate Decreases | Lower monthly payments, potential savings |

Risk management strategies:

- Consider fixed-rate options to lock in interest rates.

- Stay informed about market trends.

- Consult with financial advisors for personalized guidance.

Every financial decision should be taken with a clear understanding of its possible outcomes. Realize both the benefits and the obstacles to effectively use a line of credit to repay a mortgage sooner.

Real-world Examples And Success Stories

Real-world examples and success stories can inspire you to use a line of credit to pay off your mortgage faster. Learning from others who have successfully navigated this financial strategy can provide valuable insights into your own journey towards mortgage freedom.

Case Studies Of Effective Line Of Credit Use

Case studies spotlight how a line of credit works for paying off a mortgage quickly.

| Case Study | Initial Mortgage | Line of Credit | Time Saved |

|---|---|---|---|

| John and Jane’s Early Payoff | $300,000 | $50,000 @ 4% APR | 5 years |

| Alex’s Lump Sum Payments | $250,000 | $30,000 @ 3.5% APR | 3 years |

- John and Jane used their line of credit for mortgage prepayments.

- This cut their interest cost and shortened their loan term.

- Alex made lump-sum payments, saving thousands in interest.

Testimonials From Homeowners

Homeowners who have succeeded in cutting down mortgage time share their happiness.

“Tapping into my line of credit to pay extra on my mortgage was game-changing. Seeing my loan balance drop so quickly was incredible!” – Emma, Seattle

“I was skeptical at first, but using a line of credit worked wonders. I’m now mortgage-free and it feels amazing.” – Miguel, Austin

- Emma found the drop in her loan balance rewarding.

- Miguel recalls his skepticism and his ultimate mortgage freedom.

- Both emphasize the effectiveness of this method.

Faqs On Line Of Credit And Mortgage Repayment

Curious about using your line of credit to pay off a mortgage faster? It can be complex. Here, common questions get clear, expert-backed answers.

Common Questions Answered

- Can I use a line of credit to pay my mortgage? Yes, you can repay a mortgage with a line of credit. It’s a strategy some use to reduce interest paid.

- Does this method affect my credit score? It can. Responsible usage often improves scores. Missed payments do the opposite.

- What’s a HELOC? A Home Equity Line of Credit lets you borrow against home equity. Many use it for mortgage repayment.

- Is paying a mortgage with a line of credit risky? There’s risk, as interest rates on lines of credit can be variable. Planning is key.

- Should I fully pay off my mortgage with a line of credit? Not always advised. It’s best to balance both to optimize interest savings.

Expert Advice On Line Of Credit Management

Experts highlight clever line of credit use. They advise caution and smart planning.

- Understand Interest Rates: Learn how your line of credit’s rates compare to your mortgage’s.

- Calculate Payments: Use online calculators to see potential savings from using a line of credit.

- Consider a Schedule: Stick to a repayment plan. It helps in managing balances efficiently.

- Check Terms: Review the fine print. Some lines of credit have fees or penalties.

- Seek Professional Help: Before committing, talk to a financial advisor. Get personalized tips suitable for your situation.

Conclusion: Is A Line Of Credit Right For You?

Deciding whether to use a line of credit for mortgage payments involves planning. Understand the benefits and risks.

Summary Of Key Points

- Interest savings: A line of credit may have lower rates than mortgages.

- Flexible repayment: You can pay more when you have extra cash.

- Risk assessment: Rates can change, affecting your costs.

- Budget management: Discipline in spending ensures success.

Making An Informed Decision

Assess your financial situation carefully. Speak with a financial advisor to make the best choice. Consider these points:

| Your Cash Flow | Interest Rates | Financial Stability |

|---|---|---|

| Do you have a steady income? | Is the LOC rate better? | Are you prepared for unexpected costs? |

Remember, a line of credit can be a tool to pay off your mortgage faster if used wisely. Assess risks, benefits, and make a choice that aligns with your financial goals.

Frequently Asked Questions For How To Use Line Of Credit To Pay Off Mortgage Faster

Can I Use My Line Of Credit To Pay Off My Mortgage?

Yes, you can use a line of credit to pay off a mortgage, but carefully consider interest rates and terms before doing so.

How To Pay Off Your Mortgage With Line Of Credit?

To pay off your mortgage using a line of credit, deposit your income into the line of credit account. Then, pay your expenses from it, reducing interest over time. Reapply extra funds periodically to reduce the principal faster. Always ensure sufficient line of credit funds to avoid penalties.

What Is The Monthly Payment On A $50000 Heloc?

The monthly payment on a $50,000 HELOC varies based on interest rates and terms set by the lender. To determine exact figures, use an online HELOC calculator or consult with your financial institution.

How To Pay Off A 30 Year Mortgage In 10 Years?

To pay off a 30-year mortgage in 10 years, make extra principal payments. Refinance to a shorter-term loan if possible. Allocate windfalls like bonuses to your mortgage. Create a budget that prioritizes mortgage repayment. Consult with a financial advisor for personalized strategies.

Can A Line Of Credit Reduce Mortgage Terms?

Utilizing a line of credit to make additional mortgage payments can significantly shorten the loan term and reduce interest paid.

Conclusion

Harnessing a line of credit to accelerate mortgage repayment can be savvy financial strategy. It demands discipline and careful planning, but the rewards are substantial. By reducing interest costs and shortening your payment timeline, you create long-term savings. Embrace the potential of this approach and witness your mortgage balance shrink faster than ever.

Take control, and enjoy the freedom of being mortgage-free ahead of schedule.